KOSPI overnight futures are an essential tool for tracking global investor sentiment toward the Korean stock market after domestic trading hours. Traded on the CME during the US market session, these futures offer valuable insights into how the KOSPI 200 index may move the next day. In this article, we’ll explore what KOSPI overnight futures are, where you can check them, and why they matter for traders and investors. A helpful FAQ section is also included to answer common questions.

what are kospi overnight futures

KOSPI overnight futures are derivative contracts that reflect the expected movement of the KOSPI 200 index outside of Korean market hours. These futures are traded on the Chicago Mercantile Exchange (CME) during US trading sessions, making them an important tool for investors who want to anticipate the next day’s market behavior in Korea. Since they move in response to global economic news, political developments, and the performance of other major indices like the S&P 500 or Nasdaq, they provide a real-time sentiment gauge from international investors while the Korean market is closed.

These futures are denominated in Korean won but traded in an international context, allowing both domestic and foreign investors to hedge or speculate based on global developments. Because of their timing and influence, they’re commonly monitored by institutional traders, fund managers, and retail investors alike.

where to check kospi overnight futuresheck ou

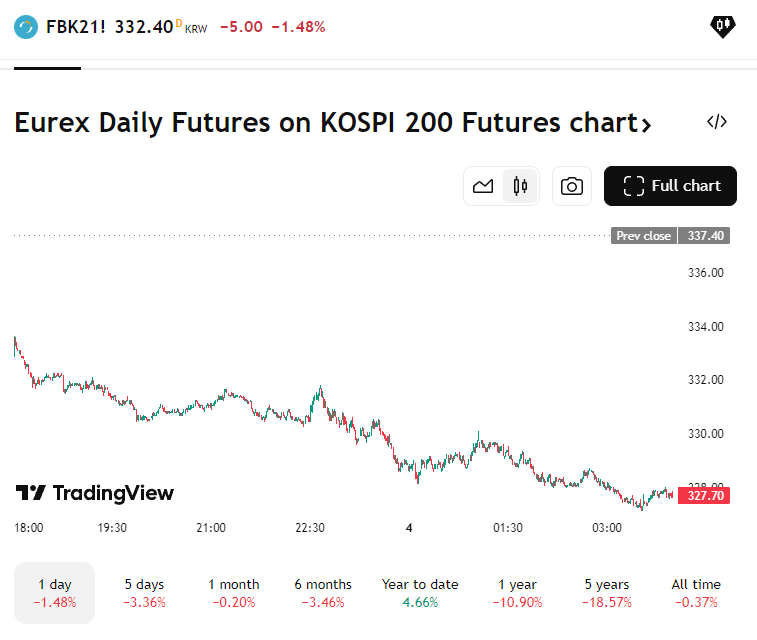

There are several reliable sources where you can monitor KOSPI overnight futures. International financial platforms such as Bloomberg, CNBC, and Investing.com offer detailed and updated information under the futures or Asia-Pacific markets section. You can search for “KOSPI 200 Futures” or find them listed under CME Group’s international equity index futures — or refer to 코스피 야간선물 보는법 for a more practical step-by-step guide.

For Korean users, platforms like Naver Finance or Daum Finance also display KOSPI overnight futures data, usually under the term “야간선물.” While updates might have a short delay compared to international sources, they are still useful for quick reference and presented in a more localized format. Additionally, some mobile trading apps provided by Korean brokerages offer real-time or near-real-time futures tracking, often with charting tools and alerts.

If you’re using a trading platform or mobile app that connects to CME, you might also be able to view live charts, historical performance, and futures depth, which can be valuable for making more technical decisions.

why kospi overnight futures are important

Understanding KOSPI overnight futures can give you a strategic advantage, especially if you’re preparing for the next trading day. Since these futures respond to events happening in the US and other major markets while Korea is asleep, they help set the tone for how the Korean stock market might open.

For example, if a major tech rally happens in the US, KOSPI overnight futures might rise, suggesting a stronger open for Korea’s own tech-heavy sectors. On the other hand, unexpected geopolitical risks or weak US economic data could push futures lower, indicating a possible drop in investor sentiment. While not a perfect predictor, the correlation between overnight futures and the KOSPI’s next-day open is often strong enough to be worth watching.

Professional traders and institutional investors use this data to plan early morning positions, while retail investors can use it as a reference for adjusting their portfolios or preparing buy and sell decisions.

frequently asked questions

what time do kospi overnight futures start and end?

KOSPI overnight futures begin trading when the US markets open, typically around 6:00 PM to 5:00 AM Korean Standard Time (KST), depending on daylight saving time in the US. This covers the full US market session, aligning with key market-moving events and economic reports.

do kospi overnight futures directly affect the kospi index?

Not directly. The KOSPI index itself is based on the real-time trading of companies on the Korea Exchange during domestic hours. However, overnight futures influence sentiment and often guide pre-market expectations. Traders and analysts closely watch them to anticipate market behavior at the next open.

can individual investors trade kospi overnight futures?

Yes, but access depends on your brokerage. Some Korean brokerages and international trading platforms allow retail investors to access CME products, including KOSPI 200 futures. However, futures trading carries a higher level of risk and may require special account approval or a margin account.

how accurate are kospi overnight futures in predicting the next day’s market?

While they are not always a one-to-one predictor, there is generally a strong correlation between the direction of KOSPI overnight futures and the opening movement of the KOSPI index. Many traders use them as part of a broader market outlook strategy combined with other indicators like the S&P 500, Nasdaq futures, or major economic announcements.